You may be ready to do your own 1099s, or to do your clients' 1099s, but is the QuickBooks data you're working with ready for you? You've heard about the 1099 rule changes and you've figured them out, you've decided to file 1099s electronically or … [Read more...]

Using the 1099 Wizard to create 1099s

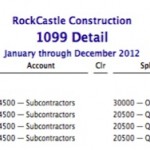

If you’re reading this, it’s probably tax time and you have some 1099-forms to file. Luckily, we have a wizard to guide you through the process of reviewing, preparing, and printing or e-filing your 1099s. Here's what you need to do to use the 1099 … [Read more...]

| You can also post your own question to the QuickBooks for Mac community. |